by Aria Jan 10,2025

Following a string of disappointing game releases and underwhelming financial performance, Ubisoft faces pressure from a minority investor to restructure its management and workforce.

Following a string of disappointing game releases and underwhelming financial performance, Ubisoft faces pressure from a minority investor to restructure its management and workforce.

Aj Investment, a minority shareholder, has publicly urged Ubisoft's board, including CEO Yves Guillemot and Tencent, to take the company private and install new leadership. In an open letter, the investor expressed deep dissatisfaction with the company's current trajectory and performance.

Aj Investment, a minority shareholder, has publicly urged Ubisoft's board, including CEO Yves Guillemot and Tencent, to take the company private and install new leadership. In an open letter, the investor expressed deep dissatisfaction with the company's current trajectory and performance.

The letter cites the delayed release of key titles like Rainbow Six Siege and The Division until late March 2025, alongside lowered Q2 2024 revenue projections and overall poor performance, as significant concerns. Aj Investment explicitly proposed replacing Guillemot as CEO, advocating for a new leader to optimize costs and studio structure for improved agility and competitiveness.

This pressure has impacted Ubisoft's share price, which the Wall Street Journal reports has plummeted over 50% in the past year. Ubisoft has yet to publicly respond to the letter.

Aj Investment contends that Ubisoft's low valuation relative to competitors stems from mismanagement and the perceived undue influence of the Guillemot family and Tencent. The investor criticizes the company's focus on short-term financial gains over long-term strategic planning and delivering exceptional gaming experiences.

Aj Investment contends that Ubisoft's low valuation relative to competitors stems from mismanagement and the perceived undue influence of the Guillemot family and Tencent. The investor criticizes the company's focus on short-term financial gains over long-term strategic planning and delivering exceptional gaming experiences.

Aj Investment's Juraj Krupa further criticized the cancellation of The Division Heartland, a move that disappointed many players. He also expressed disappointment with the reception of Skull and Bones and Prince of Persia: The Lost Crown, deeming them underwhelming.

Krupa highlighted the underperformance of several established franchises, stating that titles like Rayman, Splinter Cell, For Honor, and Watch Dogs have languished despite significant player interest. While Star Wars Outlaws was anticipated to boost performance, its initial sales have apparently fallen short of expectations, contributing to the recent share price decline. This drop marks Ubisoft's lowest share price since 2015, adding to a year-to-date decline of over 30%.

The letter also proposes significant staff reductions. Krupa points to the higher revenue and profitability of competitors like Electronic Arts (EA), Take-Two Interactive, and Activision Blizzard, despite having smaller workforces. Ubisoft's 17,000+ employees contrast sharply with EA's 11,000, Take-Two's 7,500, and Activision Blizzard's 9,500.

The letter also proposes significant staff reductions. Krupa points to the higher revenue and profitability of competitors like Electronic Arts (EA), Take-Two Interactive, and Activision Blizzard, despite having smaller workforces. Ubisoft's 17,000+ employees contrast sharply with EA's 11,000, Take-Two's 7,500, and Activision Blizzard's 9,500.

Krupa argues that Ubisoft needs aggressive cost-cutting measures and staff optimization to enhance operational efficiency. He suggests selling underperforming studios not crucial to the development of core intellectual properties. He believes Ubisoft's current structure of over 30 studios is unsustainable. While acknowledging previous layoffs (approximately 10% of the workforce), Krupa insists that further action is necessary, citing the company's planned cost reductions as insufficient to maintain global competitiveness.

Mobile Legends: January 2025 Redeem Codes Released

Pokemon TCG Pocket: Paralyzed, Explained (& All Cards with ‘Paralyze’ Ability)

Android Action-Defense

Brutal Hack And Slash Platformer Blasphemous Is Coming To Mobile, Pre-Registration Now Live

Pokémon TCG Pocket Is Dropping a Trade Feature and Space-Time Smackdown Expansion Soon

Mythical Island Debuts in Pokemon TCG, Time Revealed

GWENT: Top 5 Decks for 2025 - Strategies Revealed

Marvel Rivals Showcases New Midtown Map

Vô Cực Đại Chiến

Download

Lunch with Ronan mod

Download

Diamond Deluxe Casino - Free Slot Machines

Download

Shopping Mall 3D Mod

Download

Priya’s Awakening

Download

Flight Pilot: 3D Simulator

Download

Flight Pilot: 3D Simulator

Download

L.A. Story - Life Simulator

Download

teen patti travel

Download

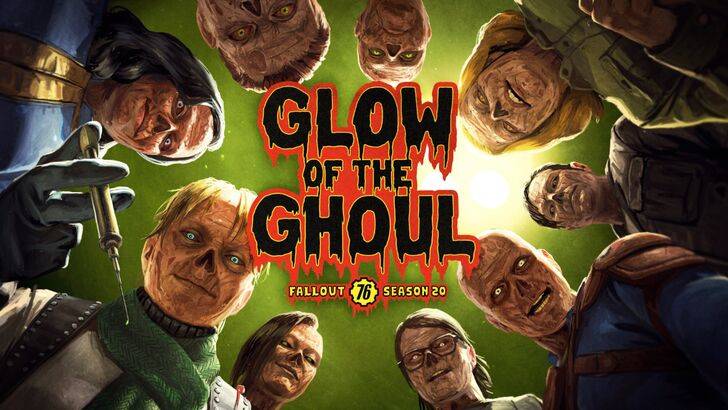

Fallout 76 Unveils New Ghoul-Themed Update

Dec 23,2025

Climate Game Atuel Launches on Android (Note: "Surrealist Documentary" was removed to meet 50-character limit.)

Dec 23,2025

Apple's OLED iPad Pro with M4 Chip Drops in Price

Dec 22,2025

Charli XCX Dance Creator Sues Roblox Over Game Use

Dec 22,2025

Path of Exile 2: Sisters of Garukhan Guide

Dec 22,2025